Construction Accounting: Navigating Taxes and Expenses in the Construction Sector

Construction Accounting: Navigating Taxes and Expenses in the Construction Sector

Blog Article

Checking Out the Significance of Building And Construction Accounting in the Construction Sector

The building market runs under one-of-a-kind economic obstacles that require a specialized method to accountancy. Building audit not only ensures the accuracy of financial coverage however also plays a pivotal duty in job administration by allowing effective job setting you back and resource appropriation.

Unique Challenges of Building Audit

Frequently, construction bookkeeping provides special difficulties that differentiate it from various other markets. One primary difficulty is the intricate nature of building and construction tasks, which frequently involve numerous stakeholders, rising and fall timelines, and differing guidelines. These elements demand careful monitoring of expenses related to labor, materials, tools, and expenses to maintain project success.

Another considerable difficulty is the demand for accurate task setting you back. Building business have to assign prices to specific tasks accurately, which can be difficult as a result of the lengthy period of tasks and the capacity for unanticipated expenses. This demand needs durable audit systems and techniques to guarantee accurate and prompt monetary coverage.

Additionally, the construction sector is at risk to transform orders and contract adjustments, which can better complicate economic tracking and forecasting. Appropriately representing these adjustments is critical to stay clear of disputes and guarantee that jobs continue to be within budget.

Key Principles of Building And Construction Audit

What are the foundational principles that lead building audit? At its core, building and construction audit rotates around precise monitoring of prices and earnings linked with details jobs.

One more secret principle is the application of the percentage-of-completion method. This method recognizes earnings and expenditures proportionate to the job's progress, providing a more practical sight of financial efficiency with time. In addition, building accounting highlights the importance of conformity with audit standards and laws, such as GAAP, to guarantee transparency and dependability in economic reporting.

Additionally, cash money flow administration is crucial, offered the typically intermittent nature of construction jobs. These concepts collectively form a robust structure that supports the unique economic needs of the building industry.

Advantages of Reliable Building And Construction Accountancy

Efficient construction bookkeeping supplies various benefits that dramatically boost the general administration of tasks. One of the key benefits is boosted economic exposure, making it possible for job supervisors to track expenditures accurately and check cash flow in real-time. This openness facilitates informed decision-making, minimizing the threat of budget plan overruns and making certain that resources are allocated efficiently.

Additionally, effective building audit enhances compliance with regulatory requirements and market standards. By preserving precise economic records, companies can conveniently give paperwork for audits and fulfill contractual responsibilities. This diligence not just cultivates trust with clients and stakeholders but look at more info additionally mitigates potential legal dangers.

Furthermore, effective audit practices add to far better task forecasting. By examining past performance and economic fads, construction firms can make even more accurate forecasts concerning future task prices and timelines. construction accounting. This capacity enhances tactical go to this site preparation and enables firms to react proactively to market fluctuations

Devices and Software for Building And Construction Accountancy

A variety of specialized devices and software application solutions are readily available for construction accountancy, each designed to enhance financial administration procedures within the industry. These tools assist in tracking, reporting, and analyzing financial information specific to building and construction jobs, guaranteeing precision and compliance with sector standards.

Leading software program options consist of incorporated building management platforms that include project budgeting, monitoring, and audit capabilities. Solutions such as Sage 300 Building and Actual Estate, copyright for Service Providers, and Viewpoint Panorama offer includes tailored to deal with task costing, pay-roll, and invoicing, enabling building and construction firms to keep exact financial oversight.

Cloud-based applications have gotten appeal because of their ease of access and real-time collaboration capabilities. Tools like Procore and CoConstruct allow teams to gain access to monetary data from several locations, boosting interaction and decision-making procedures.

Additionally, building and construction audit software usually supports compliance with governing needs, facilitating audit trails and tax obligation reporting. The assimilation of mobile applications further boosts functional effectiveness by enabling area personnel to input data straight, decreasing delays and errors.

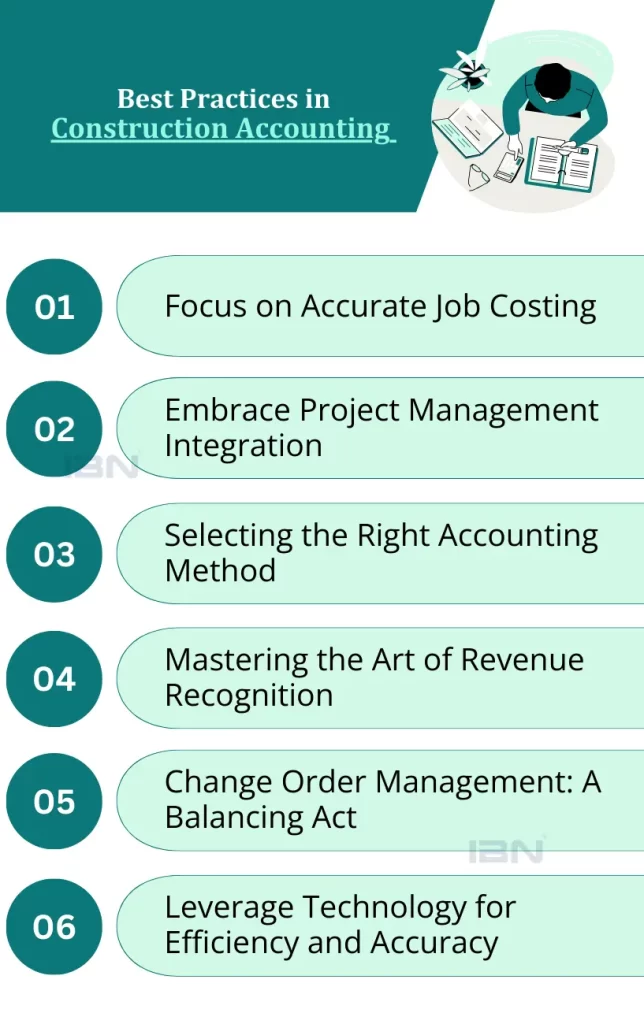

Finest Practices for Construction Financial Administration

Effective building bookkeeping depends not just on the right tools and software program however also on the application of ideal methods for economic monitoring. To accomplish reliable economic oversight, building and construction companies must focus on precise and routine task budgeting. This procedure entails breaking down job prices right into detailed categories, which permits much better tracking and projecting of costs.

Another crucial practice is preserving a robust system for invoicing and money circulation management. Timely invoicing makes sure that settlements are gotten immediately, while attentive cash circulation tracking assists prevent liquidity problems. Additionally, building companies should adopt a rigorous strategy to work costing, analyzing the real expenses versus spending plans to identify differences and adjust methods accordingly.

Continuous training and advancement of economic administration abilities amongst team make sure that the group continues to be adept at browsing the intricacies of building audit. By incorporating these best practices, building companies can enhance their economic security and drive project success.

Conclusion

In final thought, building and construction bookkeeping offers as an essential part of the building sector, dealing with unique obstacles and sticking to crucial principles that improve monetary accuracy - construction accounting. By executing finest techniques, building companies can foster stakeholder count on and make informed choices, ultimately contributing to the overall success and sustainability of tasks within the sector.

Construction accounting not just guarantees the accuracy of financial reporting but likewise plays a crucial function in project management by enabling efficient task setting you back and resource allowance. Furthermore, building accounting stresses the significance of conformity with accounting requirements and guidelines, such as GAAP, sites to make certain transparency and integrity in monetary reporting.

Successful building accounting depends not only on the right tools and software yet likewise on the implementation of ideal methods for monetary monitoring. Continuous training and growth of monetary monitoring skills amongst personnel make certain that the team stays adept at navigating the complexities of building and construction accounting.In verdict, construction accounting offers as an essential component of the building and construction sector, resolving distinct difficulties and sticking to key principles that enhance financial precision.

Report this page